In our rapidly advancing world, where emerging markets offer promising investment opportunities, it becomes essential for everyday people, not just economists, to grasp the dynamics of the stock market. The stock market is a bustling world of buying and selling shares or stocks, a slice of ownership in a company. It is critically important to understand the driving forces behind stock market trends, as they have the potential to significantly impact our economy, businesses, and personal finances. This discourse will walk you through the rudiments of the stock market and shed light on the ongoing trends to equip you with a sound comprehension of this critical aspect of modern economies.

Understanding Stock Market Basics

Mastering the Market: A Guide to Navigating Stock Market Trends Effectively

In the world of investments, the stock market is both a high-risk and high-reward financial playground where fortunes can swing as wildly as a sailor’s compass in a storm. Market trends bear a significant impact on whether your investment portfolio sails to an island of profits or sinks into the depths of losses! Grasping the fundamentals of this complex yet captivating system is essential for budding investors and seasoned traders alike.

At its core, the dynamic nature of the stock market is powered by economic indicators and company performances. When a business thrives, its share value often rises accordingly. The opposite rings true when companies face headwinds. Therefore, gauging the health of specific industries and the broader economy is crucial to make informed investments decisions. Are technological advancements disrupting traditional sectors? How’s the job market doing? What’s the latest GDP data? These are key questions for trend analysis.

Remember, the stock market reflects collective expectations rather than current realities. Consequently, keeping an ear to the ground for market sentiment and speculation can prove rewarding. Stay updated on global events and how key players in the market are reacting to such events. Investors often move as herds. Understanding this herd mentality and being a step ahead can help predict market behavior and strategizing accordingly.

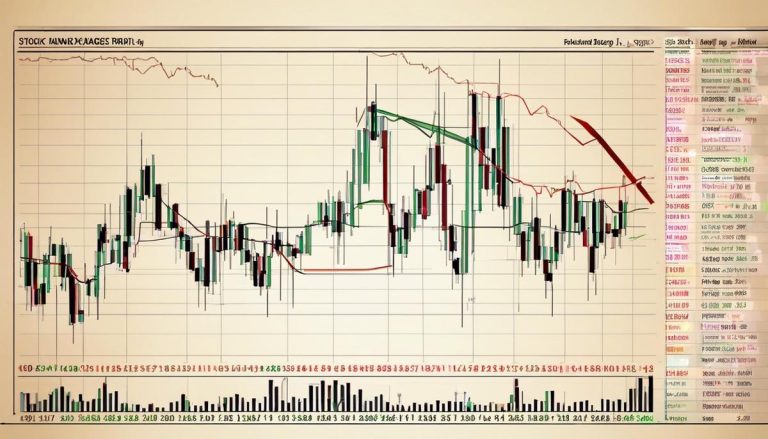

To navigate this ocean effectively, it’s important to master some technical skills. Chart reading skills, trend line analysis, and understanding technical indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands can act as the compass to steer strategy in the right direction. A good grasp of these tools not only helps identify profitable entry and exit points but also minimizes the risk of navigating blind and falling prey to market volatility.

Playing the market isn’t a game of chance or a lottery ticket to instant wealth – it requires strategic thinking and a voracious hunger for knowledge. Despite well-analyzed forecasts and projections, the market is a creature of mood swings. It is unpredictable. However, comprehending the fundamentals paired with a wide network of professional insights can lead to more informed investments, building a solid foundation upon which risk can be effectively managed.

Ultimately, managing the ship of investments isn’t just about “buy low and sell high”. It’s also about understanding the tides of trends and the unpredictable weather of market factors, then harnessing this understanding to sail towards the horizon of higher returns. Buckle up, dear navigators, for an exciting and rewarding journey across the vast seas of the stock market! Embrace the winds of change, ride the waves of growth, and remember – always keep one eye on the ever-changing horizon.

Market Trend Analysis

Unraveling the Market Trends: The Catalyst to Investment Decisions

In today’s volatile financial ecosystem, predicting market trends has taken center stage in shaping investment choices. While underscoring economic indicators and leveraging technical skills for stock market navigation is paramount, there’s an underexplored realm that remains key to unlock lucrative investment pathways: behavioral finance.

When you peel back the layers, the stock market is a complex web of human choices, driven by a plethora of emotions, not just mere numbers. Behavioral finance, thereby, underscores the relationship between investor psychology and market movements. From “fear” motivating investors to recoil from “risky” assets, to “greed” spurring a buying frenzy, these emotional extremes can often inflate or deflate market values due to human biases.

Delving into behavioral patterns, assessing the “noise level”, or public sentiment surrounding particular investments, can provide insightful cues about market direction. By synthesizing this with traditional economic factors, a more nuanced perspective of market trends can be attained. Any investor worth their salt should earmark this overlooked method in their investment tool belt.

Another critical aspect in understanding market direction lies within industry disruptors and innovation. Groundbreaking technologies or services can drastically alter the landscape of an industry, creating new trends. It could be the advent of autonomous vehicles in the automotive sector or blockchain technology in financial services. Keeping a pulse on these disruptive innovations can offer foresight into changing market trends, thus aiding astute investment decisions.

Additionally, lending a keen ear to the ground to spot emerging markets is undeniably crucial. From burgeoning economies across the globe to sectors on the brink of explosion, seizing opportunities in these areas can fortify an investor’s portfolio, ensuring they stake their claim in these fields before they fully bloom.

Finally, sector strength analysis also holds a pivotal role in deciphering market trends. This methodology involves analyzing the performance of various sectors over time against major indexes. This can provide insights into which sectors are lagging, leading or accelerating, thus presenting potential investment opportunities.

In conclusion, while economic indicators and technical skills remain irreplaceable in the stock market, the importance of understanding behavioural finance, tracking disruptive innovations, uncovering emerging markets, and performing sector strength analysis cannot be understated. Unraveling market trends isn’t a straight path; It’s more like a multifaceted treasure hunt, which requires a blend of diverse strategies and a robust, inexhaustible resourcefulness. In the vast, unpredictable ocean of stock market investing, those who can discern these currents and ride the waves will undoubtedly seize an unmatched advantage.

Stock Market Trends and Economic indicators

Fusing Macroeconomics with Market Trends: Bridging the Gap

The stock market is a kaleidoscope of numerous factors woven together, with the macroeconomic climate playing a pivotal role in shaping its trends. To stay ahead in the stock market game, it is crucial for investors to deeply comprehend how macroeconomic indicators affect market values.

At face value, macroeconomic indicators are sets of data that provide heat signatures of a nation’s overall economic prowess. They are invaluable barometers for predicting trend lines in stock exchanges. It’s essential to delve into the symbiotic relationship between key indicators such as GDP, inflation rates, unemployment rates, and interest rates, and their interplay with stock market values.

Take Gross Domestic Product (GDP) for instance; being the most comprehensive indicator of an economy’s health, it directly influences market trends. If GDP experiences an upward trajectory, it suggests that businesses are thriving, which could result in stock prices appreciating. Alternatively, sinking GDP rates are often a harbinger of declining stock values.

Similarly, currency fluctuations also have a profound impact on stock markets; a robust domestic currency can lead to higher prices of imported goods, causing a ripple effect on the profit margins of companies that rely on imported raw materials, consequently impacting stock prices.

Examining inflation rates is another cornerstone of understanding market dynamics. High inflation rates can erode company profit margins and, thereby crimp stock values. Adversely, if unemployment rates are low, it is an indication of a thriving economy and it can potentially lead to stock market gains.

Interest rates, set by the Federal Reserve, form another compelling axis in this equation. Lower interest rates can translate to increased borrowing and consequently, more investment in the market, pumping up stock prices. Conversely, higher interest rates can create a headwind for stock values due to increased borrowing costs.

It’s not an exaggerated claim to say that macroeconomic indicators and stock market trends are two sides of the same coin. If properly decoded, these indicators can serve as an entrepreneur’s roadmap for maneuvering ahead of market trends.

In the labyrinth of the market, one needs to be effectively armed with a thorough understanding of macroeconomic indicators to make informed predictions about market trends. Imparting a deep sense of numeracy and economic savviness, macroeconomic indicators are the proverbial secret weapons of successful investors—affecting company values, industry health, public sentiment, and ultimately the stock market.

In conclusion, immaculate detective work in decoding macroeconomic indicators and a familiarity with market trends is your golden ticket to a successful investment journey. Remember, the stock market isn’t a game of chance—it’s a strategic play where calculated risks often convert into higher returns. Embrace the world of macroeconomics and let it guide you towards your goals. This is the essence of the relationship between economic indicators and market trends – ingenuity at its finest. Remember, the stock market isn’t a game of random happenstance but a calculative game of chess, a careful ballet that draws heavily from macroeconomics.

Technology and Stock Market Trends

Today, beholding the rapid transformation in financial technology, or “fintech,” it is evident that digital evolution is remoulding the stock market landscape. With groundbreaking technologies – think artificial intelligence, machine learning, algorithmic trading, blockchain, and Big Data – modern tech continues to introduce dramatic shifts in the operation and accessibility of the stock market.

Artificial Intelligence (AI) is becoming integral to the stock market, revolutionizing investing and trading. AI algorithms can swiftly examine vast quantities of data, including historical trends, social media chatter, and global events, and produce swift trading suggestions. These algorithms make decisions in a fraction of a second, often before a human trader can react, offering a notable competitive edge.

Moreover, AI eliminates emotional bias, responding solely to market conditions. This objective analysis is critical in a volatile market, where emotions often cloud judgement, potentially leading to rash decisions and consequent financial losses. Such technologies bridge gaps between skillful expertise and neophyte investors, democratising the world of finance.

Machine learning, a subset of AI, is also gaining traction, notably for its predictive capabilities. By discerning patterns from large volumes of data, these systems can predict future trends with unprecedented accuracy. They continually refine their predictions as more data becomes available, facilitating more informed decision-making. From predicting stock price movements to detecting fraudulent transactions, machine learning’s practical implications are vast, rendering it a potent tool for investors and market analysts alike.

Algorithmic trading has unleashed a new era of efficiency and speed. Advanced algorithms simultaneously assess multiple market conditions and execute trades at superior speeds, enhancing productivity and reducing possibilities of human error. Trading algorithms are beneficial to both individual and institutional investors, empowering them to execute high-frequency trades and test potential strategies before actual implementation. This precision, combined with speed, can boost profitability and ensure the maintenance of a robust portfolio.

The manifestation of Blockchain technology in financial markets promises transparency, security and decentralization. Immutable and distributed ledgers eliminate dependence on intermediaries, thereby reducing costs and increasing efficiency. Blockchain’s potential isn’t limited to cryptocurrencies. It can transparently track asset ownership, combat fraud, and expedite clearing and settlement of trades—renders blockchain a potential game-changer in the realm of stock market investing.

Big Data, and its ability to process massive volume of complex data at extraordinary speed, further amplifies trend forecasting potential. Data from internet searches, transaction records, social media feeds, and even weather reports can collectively contribute to a more holistic prediction model, thus improving forecasting accuracy and offering market players a significant competitive edge.

The integration of these technologies not only revolutionizes transaction methods and procedures but also deepens insights into market churning, augments transparency, and ultimately, propels the profitability of strategic investments. Modern technology in the stock market environment is not only reshaping the current landscape but building resilient, efficient, and inclusive future financial markets. As these technologies emerge, adapt, and mature, they promise to keep the fascinating world of stock market investing in continuous flux. Remember: adaptability is key. The savviest investors will be those who leverage these technological advancements to their advantage, staying ahead in the game of rapid digital evolution.

Photo by austindistel on Unsplash

The world of stocks and trading may seem puzzling initially, but with a focused approach and consistent learning, it becomes relatively easy to grasp. Understanding and correctly interpreting stock market trends can be the difference between solid gains and disappointing losses. Familiarity with economic indicators and their role in the stock market, coupled with the knowledge of how trend lines, support, and resistance work, will give you a powerful toolkit for informed investing. Moreover, recognizing the critical part of evolving technology, especially big data and AI, in shaping and decoding trends, can give you an edge in navigating the stock market of the future successfully. Remember, knowledge is power when it comes to investing, and the more you know, the better your chances of making a winning move in the thrilling world of stock investment.