In today’s high-paced financial era, stock market indices serve as crucial indicators of the health of the economy and financial markets. Their role transcends just tracking market performance to facilitating the creation of investable portfolios and setting benchmarks for investment strategies. The vast global network of indices like the DJIA, S&P 500, NASDAQ Composite, FTSE 100, Nikkei 225, and more not only reflect economic vigor but also shape global finance. Yet, the complexities of stock market indices often remain mysterious to the general public. Thus, acquiring understanding of these indices, how investors utilize them, and their potential risks is elemental in navigating the financial world.

Understanding the Function of Stock Market Indices

Decoding the Key Roles of Stock Market Indices in the Global Financial Ecosystem

In the sprawling landscape of global finance, stock market indices play pivotal roles, becoming indispensable reference points for investors and financial mavens worldwide. Their influence transcends geographical boundaries and industry segments, thereby reaffirming their prominence in shaping economic development.

At the heart of every successful investment strategy lies the art of diversification, and stock market indices serve as the fundamental yardsticks in this endeavor. They provide critical insights into the performance of a specific segment of the stock market, delivering a macroscopic overview that empowers investors to make informed decisions. It’s this ability to probe the nuances of vast markets that has exponentially increased the relevance of indices in contemporary financial scenarios.

Indices also substantially steer market sentiment. Shifts in key market indices trigger corresponding peaks and troughs in investor confidence, often driving substantial economic repercussions. A positive surge in an influential index such as the S&P 500 or the Dow Jones Industrial Average doesn’t merely buoy the spirits of Wall Street moguls; it also fuels optimism globally, pointers towards strong market performance in the offing.

Stock market indices serve as the silent sentinels of the global economy, providing valuable data that unveils the intricacies of multiple industries. Intricate market trends, sectors’ performance, and the health of key business regions are unveiled by observing index movements. No longer are indices mere statistical facts. They are the living barometers of economic prosperity and decline.

The dynamic and evolving financial realm needs definitive benchmarks to measure growth. Here, indices don the role of unbiased evaluators. Comparative analysis of a company’s performance is enabled vis-à-vis their industry counterparts. Measuring the relative performance is instrumental in investment theory, financial models, and risk management approaches.

Finally, market indices constitute the backbone of numerous financial products. A wide array of exchange-traded funds, mutual funds, futures, and options exist based on these indices. The burgeoning rise of index-based investment products has accelerated the versatility and ubiquity of these measurements, thus opening newer avenues for investment strategies.

In conclusion, stock market indices aren’t just numbers on a screen. They are the lifeline of our global financial ecosystem. Their multifaceted roles ensure a balanced finance environment and channelize the essential stream of information that powers investment decisions worldwide. Hence, their understanding and appropriate utilization act as a definitive springboard for investor success in today’s fast-paced, digitized world of finance.

Top Global Stock Market Indices

Entitled “The Titans of the Trade: World’s Most Influential Stock Market Indices”, our exploratory journey examines these financial behemoths and their impact on the global marketplace. This comprehensive overview is indispensable for anyone aiming to understand the complexities of finance and investment, even for those beyond the specter of Wall Street.

Two behemoths that instantly captivate the globe’s attention are the Dow Jones Industrial Average (DJIA) and the Standard & Poor’s 500 (S&P 500), both key indicators of the economic health of the United States. The DJIA, composed of thirty robust companies, provides a clear picture of how major industries in the country are performing. The S&P 500, containing a more diverse portfolio of 500 companies, serves as a reliable benchmark of the US stock market.

On the other side of the world, the Nikkei 225, a price-weighted index encompassing Japan’s most prominent companies, impacts Asia’s market sentiment. Also significant within the continent is China’s Shanghai Composite Index, a barometer of the economic activities in the world’s second-largest economy. Undoubtedly, these represent some of the most influential indices outside of the US.

Europe’s financial prowess is represented by indices such as the FTSE 100 and the DAX. The FTSE 100, handling the 100 largest companies listed on the London Stock Exchange, serves as an economic indicator for the global significance of the UK. Meanwhile, Germany’s DAX provides insights into Europe’s largest economy’s performance, reflecting the value of its 30 largest listed companies.

It’s important to note that many emerging market economies, such as Brazil’s Bovespa Index and India’s BSE SENSEX, have been gaining prominence due to their potential high yield compared to developed markets. Their influence illuminates the diversification potential to investors.

In today’s digital era, the ability to track these indices is more accessible than ever before. Technological advancement has paved the way for innovative financial products, like Exchange Traded Funds (ETFs) and Index Funds that replicate the performance of major indices. They are favored by investors for their low expense ratios and the ease of diversification that they offer.

In a fluid and complex financial landscape, it is crucial to keep abreast of influential indices’ movements and implications. These indices not only reflect economic activity but can also guide future expectations and investment strategies. Adequate understanding and intelligent use of these market indicators can position investors, both seasoned and budding, to make informed decisions and possibly yield notable returns. From Wall Street to Shanghai, the pulse of the global economy can often be taken from the movements of these primary indices.

Investment Strategies using Stock Market Indices

Leveraging stock market indices for a strategic investment approach goes beyond simply understanding their role and significance in modern global finance. Let’s delve deeper and explore some practical ways investors can harness the power of these vaulted benchmarks to make calculated moves in their investment endeavors.

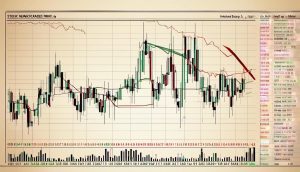

Strategically exploiting trends is an effective technique for those keen on leveraging stock market indices. For instance, an investor may notice the Nikkei 225 index following a rising trend, which may indicate an optimal time to invest in Japanese stocks or related ETFs. Likewise, you could identify a negative trend with the FTSE 100, suggesting it might be time to seize short-selling opportunities or pivot your investments toward other markets.

Another method involves aligning your asset’s allocation with the weight of different sectors in a particular index. For example, if the S&P 500 is heavily weighted towards information technology stocks, an investor may consider increasing their holdings in this area. By mimicking the allocations of successful indices, an investor can potentially maximize their portfolio’s profitability while mitigating the risk.

Also of noteworthy mention is the use of advanced technology for index tracking. In today’s data-driven investment world, harnessing the power of AI and machine learning can provide valuable insights into index trends and potential pivot points. Utilizing these technologies can provide a competitive edge that raises the effectiveness of your index-based investment strategy.

A fundamental understanding of Index Funds and ETFs can also prove beneficial. As pools of securities that follow the performance of a specific index, these can ease the diversification process. This can be especially useful for new investors by allowing strategic exposure to various sectors without the need to buy individual stocks.

Keeping a keen eye on fluctuating index values can also aid in deciding the timing of your investments. For example, watching for sudden dips in the DJIA or the DAX can provide advantageous entry points to boost potential returns. Similarly, identifying upward surges might suggest the opportune time to sell.

Remember that these are not mere data points but narratives that reflect the economic health of regions and sectors. In a globally interconnected financial ecosystem, the implications of movements in Brazil’s Bovespa Index can have ripple effects on U.S.’s S&P 500 or India’s BSE SENSEX.

Lastly, never underestimate the power of continual learning. Staying updated about index movements and understanding the complexities of diverse regional markets is paramount. This continual learning feeds into shaping investment strategies using market indicators. It’s this blend of evolving information and practiced insight that helps investors transform indices from passive benchmarks to active instruments of investment success.

Ultimately, the intelligent use of indices could act as a catapult that propels your investment portfolio to new financial heights. It’s about seeing what the numbers imply, leveraging the trends, aligning with popular allocations, and understanding the interconnectivity that our global financial market presides. The power of indices stretches far beyond a measurement dash; they are guides helping to navigate the world of investments in this modern digital age.

Impacts and Risks of Stock Market Indices

Notwithstanding their significance, it is key to understand the potential risks and impacts associated with stock market indices. A broad understanding not only encompasses index-based investment strategies, but also entails identifying and mitigating adverse situations. Embracing this mindset aids in strategizing for unforeseen circumstances, and ensures resilience in the face of fluctuations in global markets.

The first undeniable risk is market exposure. While indices can be helpful in diversification and managing risk, they also expose investors to the whipsaw gyrations of the market. Thus, while an index may minimize the specific risk associated with individual securities, it cannot eliminate market risk. Given indices carry the day-to-day volatility of the market, for some investors, particularly those near retirement, the risk may be larger than their stomach for potential losses.

Next, tracking error is a risk. It is the divergence between the price behavior of a portfolio or fund, and the price behavior of a benchmark. This occurs when the ETF or index fund does not precisely mimic the index it is supposed to track. Slight disparities in returns are almost inevitable due to fund expenses, timing of trades, and changes in the index’s component securities. Significant tracking errors can affect portfolio performance, underscoring the need for regular monitoring and astute selection of investment vehicles.

Another important element to consider is weighting strategy. Indices are either price-weighted or capitalization-weighted. These differing strategies can hugely impact returns from index-based investments. Indexes with high concentrations in certain sectors or stocks can result in investment portfolios that lack diversity. This highlights the importance of identifying an index’s weighting strategy before choosing to invest.

Also, it’s insufficient to study and understand an index tracker today, and assume that knowledge resolutely stands for tomorrow. Indices are living, dynamic entities. As such, their compositions regularly evolve based on changes in the market value of their components, the emergence of new industries, or revisions in the methods of calculation.

The regulatory environment is a further factor. Government laws and regulations regarding financial markets and investment products can have a direct impact on stock market indices. Changes in these laws could potentially influence not only the components of the index, the traded securities in the market, but also the behavior of investors, thereby altering market performance.

Equally compelling is the impact these indices can have on broader global financial implications. Recognizing that index movements affect public sentiment towards the economy, and have far-reaching effects on both consumer spending and corporate investment, is integral. These fluctuations also have implications for national monetary policies, as central banks rely on these indices to help steer their decision-making process and monitor economic health.

In conclusion, these potential risks and impacts underline the crucial need for investors to remain informed, adaptable, and ready to respond to ever-changing market dynamics. Savvy investors mitigate these risks through continual research, strategic planning, and by leveraging the power of technologies that offer timely alerts and comprehensive reports. With the right mindset, preparedness, and ongoing education about stock market indices, smart investment decisions that celebrate both benefits and risks can be made.

Having penetrated the intricacies of stock market indices, their global influence, investing tactics, and correlated risks, it’s clear that these indices offer more than a mere financial weather vane. While they signal market trends and assist in forming investment strategies, an understanding of their inherent volatility and potential for market manipulation is essential. Nevertheless, indices should not be considered a foolproof indicator of individual stock performance. The knowledge gained here serves as a preliminary stepping stone towards making informed decisions in the financial markets, fostering one’s investment journey with a comprehensive, balanced perspective.