Stock market bubbles and crashes have perennially dotted the landscape of global finance, inducing ripples of economic instability that transcend national borders. Understanding these phenomena requires a deep dive into an intricate labyrinth of finance, economics, and human psychology. Our discussions prod beneath the surface of basic definitions, shedding light on the multifaceted consilience of investor sentiment, market speculation, and financial innovation that engenders these market situations. Leveraging historical perspectives to comprehend recurring patterns, we navigate the realm of behavioral finance to comprehend the human element, culminating in an exploration of risk mitigation and recovery strategies in the shadow of these market oscillations.

Definition and Explanation of Stock Market Bubbles and Crashes

Examining Stock Market Bubbles and Crashes: An In-depth Analysis of Underlying Mechanisms

The economic landscape is marked by periods of expansion and contraction, illustrated either by plump bubbles ready to burst or sinking crashes, ready to plunge the markets deep into the abyss. These phenomena, while dramatic, remain a quintessential part of the economic cycle. However, in pursuit of a profound comprehension, it is germane to delve into the intricacies that define and underpin stock market bubbles and crashes.

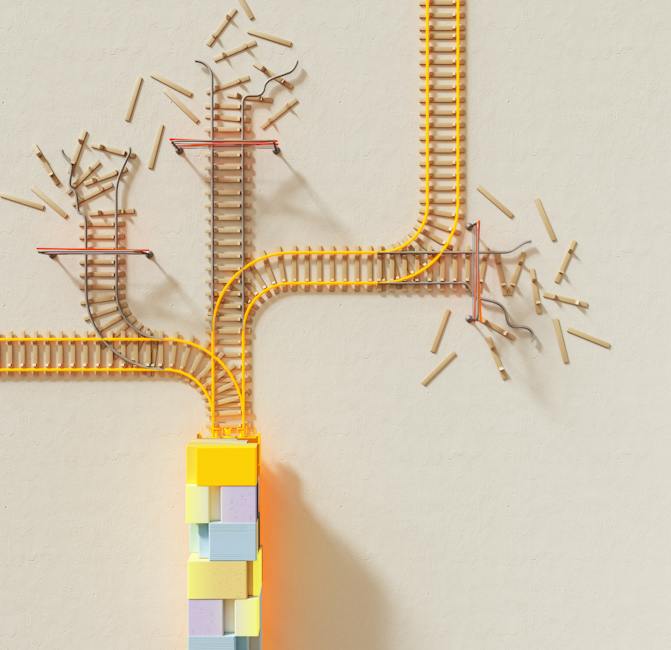

In the realm of the financial market, a bubble constitutes the inflation of asset prices significantly above their intrinsic value. Frequently fueled by irrational exuberance or rampant speculation, these bubbles are often driven by a widespread opinion amongst investors that they can sell their over-priced assets for a higher price to another investor. This financial version of “hot potato” can lead to a precipitous expansion in the market price of assets, entirely untethered from their real value.

At first glance, the period of a bubble appears to bestow enormous wealth. However, in essence, this phantom prosperity hails the onset of a potentially debilitating crash. As the market starts to acknowledge the colossal chasm between asset prices and their fundamental value, panic sets in. The bubble bursts, triggering a rapid and frequently steep decline in asset prices, marking the commencement of a stock market crash. These crashes often lead to recessionary periods and severe economic contractions due to abrupt decreases in market liquidity and investor confidence.

Therefore, to demystify stock market bubbles and crashes, it is pivotal to understand the core mechanisms underpinning their occurrence. Despite rigorous studies on financial economics, the exact causes remain open to interpretation, depending heavily upon the nuances of a specific economy. Nevertheless, several seminal principles frequently orchestrate these events.

One critical underpinning principle is the behavioral aspects of investors. Psychological biases often drive irrational decisions leading to overoptimism or panicky reactions. Optimistic investors contribute to the formation of bubbles as they drive prices upwards based on perceived future gains rather than actual financial performance. Conversely, panicky selling during periods of market turbulence can trigger damaging crashes.

Meanwhile, the role of financial innovations and lack of regulation play a significant part during these volatile episodes. Novel financial products enable new forms of speculation, leading to increased leverage and asset price inflation. Simultaneously, inadequate regulation fails to rein in risky behavior, allowing bubbles to inflate and eventually orchestrate a collapse.

Last, external shocks, such as economic downturns, political instability, or pandemics, can destabilize financial markets. These sudden events can lead to significant market contractions, expedite the bursting of existing bubbles, and trigger rapid declines in asset prices, defining a crash.

Thus, stock market bubbles and crashes, while often viewed as anomalies, are inherent parts of economic cycles, interwoven into the financial fabric of our society. Driven by behavioral tendencies, financial innovations, regulatory inadequacies, and external shocks, their understanding requires a layered approach that engages with the complexities of economic theory, psychological biases, regulatory mechanisms, and macroeconomic conditions. Through a keen understanding of these events, safeguards can be established, potentially mitigating the consequences of future financial turbulence.

Historical Overview of Stock Market Bubbles and Crashes

The annals of financial history host a vivid tableau of occurrences that dramatically reveal stock market bubbles and resultant crashes. Careful multidisciplinary examinations of these episodes bring to light discernable patterns that serve as compass points to financial scholars and meticulous investors alike.

Notably, the 17th century bore witness to what economists extensively acknowledge as the first recorded bubble, coined the “Tulip Mania.” This event, centered in the Netherlands, led to an irrational spree of speculating on the prices of tulip bulbs, thereby inflating their prices to incredible heights, only to collapse abruptly in 1637. Though this was not a stock market bubble, it presages the pattern of market phenomena that would frequently recur in subsequent centuries.

Emerging from the shadow of the Tulip Mania, the Mississippi Bubble of the 18th Century added a new layer to our understanding. John Law, a Scottish financier, established a company speculating a gold mine of opportunities in the French colonies surrounding the Mississippi River. This led to fierce speculation and overvaluation in the share’s prices of Law’s company, culminating in a swift crash in 1720, thereby reminding the world of the need for scrutiny of natural and reasonable value in assets.

Fast forward to the dusk of the 19th Century, the Wall Street crash of 1929, or the Great Crash, marked the onset of the Great Depression. A period of speculative boom led to economic prosperity, which in turn affected the psychology of investors, leading to aggressive buying, and overvaluation of stocks. The bubble burst, dragging the world economy into a decade-long depression, underlining the need for robust economic and regulatory practices to mitigate market exuberances and crashes.

The Dot-com bubble dispute of the 1990s adds another dimension to our understanding. Driven by the novelty of the internet and its potential, investors poured enormous funds into internet-based startups. However, valuations were disconnected from fundamentals, and when the exuberance subsided, the market value eroded, leading to the crash in 2000. The Dot-com bubble is a profound example of the role of financial innovation and its consequences if left unchecked.

Moving into the 21st Century, the crash of 2006-2008, often noted as the Great Recession, stems from a real estate bubble developed due to aggressive lending and excessive financial innovation via mortgage-backed securities. When the housing market crashed, it signaled the severe economic downturn, the effects of which were globally widespread and long-lasting.

An analysis of these potent historical events uncovers a pattern painted by elements of speculation, irrational exuberance, financial innovation, loose regulations, and often external shocks. These phenomena factored into the creation of bubbles and subsequent crashes. It is within these patterns that we uncover the recurring leitmotifs that manifest themselves throughout the tempestuous narrative of the stock markets’ history. This recognition and understanding, thus, become critical in predicting and guarding against future financial calamities.

Psychological and Behavioral Aspects in Stock Market Bubbles and Crashes

Delving deeper into the intricate relationship between human psychology and stock market trends, we now turn our attention to the following aspects, offering an engaged analysis in the process.

Firstly, Herd Behavior and Confirmation Bias warrant consideration in this context. Herd behavior entails the tendency of individuals to mimic the actions of a larger group, whether rational or irrational, dictated by the assumption that collective actions carry higher weight. This behavior, augmented by a Confirmation Bias, propels stock market bubbles. Confirmation bias refers to the inclination to seek out and affirm information that validates one’s views, often at the peril of contrarian data. Together, these create an echo chamber, ignoring potential hazards in stock markets.

Next, Overconfidence and Self-Attribution Bias also influence market bubbles. Overconfidence propels risk-taking, while Self-Attribution Bias convinces investors about their superlative predictions and decisions. This dual mechanism escalates the formation of bubbles by particularly encouraging irrational exuberance.

Thirdly, the Disposition Effect and Loss Aversion are crucial tools for understanding stock market crashes. The Disposition Effect describes an investor’s inclination to sell winning investments while holding onto losers, often resulting in sub-optimal returns. Simultaneously, Loss Aversion phenomenon manifests when investors amplify the impact of potential losses compared to gains. Together, these contribute to volatility and swing the pendulum towards a market crash.

Lasty, anchoring bias, where investors make decisions based on the initial purchase price or market levels, rather than an updated analysis of intrinsic value, intensifies the volatility of bubbles and eventual crashes. This lack of adjustment to new information perpetuates the risk of disproportionate price movements.

Turning to historical perspectives, they effectively elucidate the impact of these aforementioned psychological behaviors, through critical evaluations of recurring themes across different eras. For example, during both the Mississippi Bubble and Wall Street Crash, Herd Behavior was glaringly apparent while the recent Dot-Com Bubble aptly illustrates the outcome of Overconfidence and Self-Attribution Bias.

Moving beyond these evaluations, one must not underestimate the profound impact of technology, namely Financial Innovation. This amplifies psychological biases, by offering novel avenues for speculation, as seen during the Dot-Com Bubble. Furthermore, softer regulations can inadvertently condone and escalate irrational behavior, leading to larger, more destructive crashes.

Conclusively, the external shocks that arise from geopolitical conjectures or pandemics like COVID-19 impose unanticipated fuel on these ingrained psychological biases within investors, thereby augmenting market instability. This readily demonstrates the synergy between human behavior and economic conditions in scripting financial market narratives. Hence, collective introspection and awareness about these inherent psychological biases offer a tangible path forward to ensure long-term financial market stability.

Mitigating and Recovering from Stock Market Bubbles and Crashes

As we delve deeper into the labyrinth of financial markets and its inherent risks, a paradigm shift occurs, steering us towards the realm of prevention and mitigation strategies against market bubbles and crashes. It follows therefore, to explore the strategic course of action that can be employed to buffer against these recurring economic phenomenons.

A potent initial step in evading a stock market bubble lies in identifying it prior to its full formation. Key indicators worth monitoring for signs of a bubble include the rapid acceleration of asset prices, increased market trading volumes, and unusually high leverage amongst investors. These agricultural indicators, akin to spotting the first green sprouts in a spring field, can serve as early warnings, allowing for proactive steps to be taken before the bubble inflates further.

Once a bubble is discerned, regulatory bodies and governmental institutions can implement monetary and fiscal policies aimed at cooling the overheated market. This could range from adjusting interest rates to deter leveraged investments or tightening monetary policy to reduce liquidity in the market. Regulatory measures can also focus on maintaining transparency, ensuring that accurate and complete information is available to all market participants, which in turn enables sound decision-making and averts excessive speculation.

Further, the imposition of stricter regulatory measures pertaining to margin requirements or restrictions on certain types of speculative trading may also curb the frenzy often associated with bubble formation. Essentially, these regulations seek to rein in over-exuberance and speculative behavior, steering investors towards reasonable risk-taking.

It must not be disregarded that these preventive measures, though critical, are not foolproof. Therefore, setting in place strategies for recovery post market crashes becomes indispensable. Post-crash recovery efforts can include fiscal stimulus packages to jump-start economic activity, as well as conducting thorough investigations to identify the root causes of the crash and institute necessary reforms.

Beyond economic policy and regulatory measures, fostering an environment of financial literacy and awareness to guard against irrational exuberance is vital. Savvy investors equipped with sound understanding of market dynamics and reasonable expectations of return are less likely to contribute to bubble formation.

At a granular level, investors themselves also play a critical role in mitigating stock market crashes through diversified investment portfolios. This widely recommended strategy can insulate investors from the adverse effects of crashes, providing a cushion against severe losses due to over-concentration in one asset or sector.

Finally, the recovery process necessitates a reassessment of market infrastructure. This may involve reconsidering risk management models, compliance structures, and transaction mechanisms that proved to be inadequate in protecting the market from crashing. For instance, implementing automatic circuit breakers or trading halts in times of excessive market volatility can prevent panic selling and preserve market integrity.

In summary, the quelling of market bubbles and crashes encompasses the joint efforts of regulatory bodies, government institutions, and individual investors, underpinned by transparent and comprehensive market information. Failure to learn from past market downturns can replicate scenarios of financial upheaval. Nevertheless, the employing of these mitigation and recovery strategies can engender a more resilient financial ecosystem, veering away from the calamitous trajectory of bubbles and crashes.

The stock market’s whimsical nature, teetering between exuberant bubbles and sudden crashes, represents both compelling opportunities and devastating risks for investors, policy makers, and the wider economy. As history outlines recurring trends, it becomes evident that understanding these market dynamics necessitates an appreciation of both financial mechanisms and human psychology. The synchrony of these elements often drives market instability, making it pivotal to devise robust risk mitigation, regulation, and recovery strategies. Building a financially stable future relies, to a great extent, on the collective cognizance of these aspects, fostering an educated and resilient approach to navigating the vast, volatile seas of the stock market.